What Is Alternative Data?

How to use it for investment analysis

What Is Alternative Data?

Compared to traditionally used data (Traditional Data) such as financial statements and economic statistics, mainly in the financial industry, Alternative Data refers to data that has not been available so far.

Typical Examples of Alternative Data

- ・POS Data

- ・Credit Card Data

- ・Geolocation

- ・Satellte Images

The data traditionally used for economic analysis has had issues with its timeliness and accuracy. For example, GDP, the most widely used economic statistic, is released once a quarter with a time lag of a month and a half. Also, as discussed in some governments, the problems of (1) sample bias in the data collection process, and (2) not covering emerging industries like EC have been pointed out. In short, traditional data has a problem with its comprehensiveness.

Under these circumstances, quantitative funds (investment funds that operate based on quantitative analysis) have been the mainstream of this investment strategy. There is a growing trend to use alternative data.

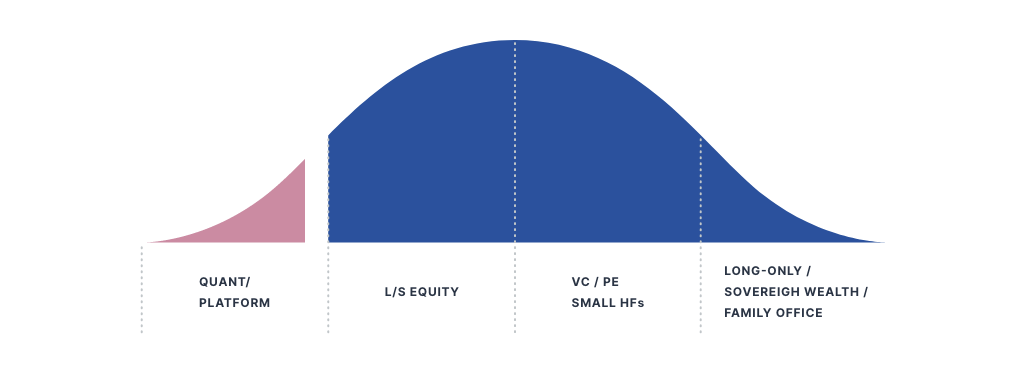

Figure 1. The process of dissemination of

alternative data in the asset managment industry

Source: AltanativeData.org

In the U.S., where the market has already matured, it is said that not only quantitative hedge-funds, but also mutual funds, central banks, manufacturers, retailers, and so on are using alternative data to make investment, policy, and business decisions (*2).

How Does Alternative Data

Change Equity Investment Analysis?

Equity investment research has a history of evolving with the expansion of available information and data.

For example, when equity analysts looked at individual companies, financial statements (balance sheets and income statements) and market data were already widley used prior to the 1990s.

However, since the fiscal year ended March 31, 2000, the obligation to prepare and publish cash flow statements on a consolidated basis has come into effect. The use of cash flow statements for what is called ”financial analysis” has become commonplace.

Now the trend has shifted toward alternative data. In the U.S., alternative data is already not an “alternative” but being used as “mainstream”. For example, in order to predict the result of the year-end sales, credit card data is widely used (*3).

In contrast, in Japan, the use of alternative data has not yet been wideley adopted; however, this trend is gradually spreading. For example, a number of asset management companies are setting up specialized departments.

The following pages provide a more detailed explanation of the types and characteristics of alternative data.

Alternative Data for Data Holders

Thus, alternative data is changing the way economic analysis is conducted, especially in the financial industry, and in addition, for data holders (companies that have big data), it can also be a huge opportunity to use their big data for business purposes.

Nowcast have helped data holders to create alternative data businesses since the day we were founded. In the following pages, we'll describe some of our case studies to illustrate the value of the alternative data industry.

Use Cases of Alternative Data

Nowcast has been offering alternative data services mainly based around consumer transaction data such as POS data and credit card data. Below are some alternative data use cases, including those from Nowcast.

Nowcast's Alternative Data Services

The following pages describe how a variety of alternative data can be used by investors and economists. We also introduce the daily price index, along with examples from Japan and abroad

Daily Price Index from POS data (Nikkei CPINow)

Nowcast was founded by Tsutomu Watanabe, Dean and Professor of Economics, University of Tokyo. He started a project called “UTokyo Price Project”, the forerunner of our company. Currently, the UTokyo-made daily price index has been renamed Nikkei CPINow, and it is widely used by a lot of institutions, investment banks and think tanks.

This service is useful as a supplementary price statistic dataset with a two-day time lag to the monthly Consumer Price Index, which has a one-month time lag. Some usage examples include providing a vivid snapshot of the last-minute demand before the consumption tax increase and the subsequent dowturn in demand, as well as panic buying of foods and daily necessities under the COVID-19 crisis.

Development of real-time consumption statistics from credit card data (JCB Consumption NOW)

Nowcast is also enthusiastic about analyzing credit card data. Credit card data can be used to indicate where a product was bought and what kind of people are buying it.

Furthermore, unlike POS data, the data coverage is not limited to retail industries such as supermarkets and drugstores. The data can cover digital and service industries such as museums, amusement parks, e-commerce, movies. It is possible to capture a wide range of consumption activities. In this regard, credit card data is the best alternative data to develop consumption statistics.

From these perspectives, Nowcast teamed up with JCB Inc. (a Japanese credit card issuer ) and we have developed and provided “JCB Consumption NOW,” a new consumption statistics that utilizes credit card data. 。

Analysis on the individual companies sales using consumer transaction data

Alternative data can be utilized not only for macro economic analysis but also individual companies sales analysis. COVID-19 caused the social issue where companies cannot disclose financial statements on schedule (※4). This problem can be solved by consumer transaction data such as POS data and it will decrease the uncertainty in the market.

Nowcast is using consumer transaction data including Nikkei POS, TrueData, Tpoint data and so on to analyze BtoC businesses such as food, daily necessities and retail sectors.

※1… For example, economists at Fed showed how effective consumption statistics based on credit card data is in the following paper.

Aladangady, A., S. Aron-Dine, W. Dunn, L. Feiveson, P. Lengermannm, and C. Sahm, 2019. “From Transactions Data to Economic Statistics: Constructing Real-time, High-frequency, Geographic Measures of Consumer Spending.” NBER Working Paper 26253, National Bureau of Economic Research.

※2…CNBC” Record online sales give US holiday shopping season a boost” (2019/12/26)

https://www.cnbc.com/2019/12/25/reuters-america-corrected-record-online-sales-give-u-s-holiday-shopping-season-a-boost-report.html

※3… Nikkei “Accelerated Development of AI-Driven Asset Management”

https://www.nikkei.com/article/

DGKKZO22182590S7A011C1EE9000/

※4…FSA in Japan announced that the deadline of annual securities report of listed companies is rescheduled into the end of September without any additoinal/individual applications to them.